Naturalization Application

Can I naturalize even if I haven't paid my pension premiums?

- 2025.02.03

“I haven't paid my pension, but can I naturalize?” “There was a period when I didn't pay my pension, but does that affect my naturalization?” “Is it possible to naturalize even if I'm not enrolled in the pension system?” We sometimes receive questions like these from foreigners who are considering naturalization. So, this time, we'd like to look at the relationship between naturalization and pensions.

Japan’s public pension system

Before we get into the explanation of naturalization, let’s first take a quick look at what public pensions are.

The public pension system is a system that provides pensions to the members and their surviving family members in the event of old age, disability, or the death of a family member, which enables members to support each other. The system design varies from country to country.

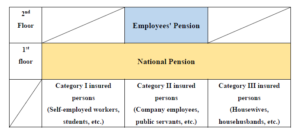

Japanese public pension system is said to be like a two-story house: the National Pension and the Employees’ Pension. As shown in the diagram below, the National Pension is the basic pension and applies to the insured persons of Category I, II, and III. The Category II insured persons are further covered by the Employees’ Pension.

Now, what are the National Pension and the Employees’ Pension? Let’s take a look together!

National Pension

The National Pension is also called the “universal pension,” and by law, “persons aged 20 to 60 who have an address in Japan” must join (see Article 7, Paragraph 1 of the National Pension Law). Although it is called the “National Pension,” Japanese nationality is not required, so foreigners are also subject to the system.

The National Pension premium is 16,980 yen per month (as of December 2024). In principle, if you pay the premium for 10 years, you can receive a pension from age 65. In addition to these old-age benefits, there are also survivor benefits and disability benefits.

Employees’ Pension

Employees’ Pension is mandatory for a “person under 70 years of age who is employed at an applicable place of business” (see Article 9 of the Employees’ Pension Insurance Act), and even a “person under 70 years of age who is employed at a place of business other than an applicable place of business” can join if approved by the Minister of Health, Labor and Welfare (see Article 10 of the same act).

(*Please note that “applicable place of business” refers to workplaces that are subject to the Employees’ Pension.)

The premium for the Employees’ Pension is 18.3% of the monthly salary of the member (as of December 2024), but the company pays half of the premium, so the actual burden on each member is 9.15%.

In addition, like the National Pension, the Employees’ Pension also provides old-age benefits (from age 65 in principle), survivor benefits, and disability benefits. As explained above, the Employees’ Pension is something that is added to the basic pension (i.e. the National Pension), so the amounts of those benefits include the amounts paid as benefits from the National Pension.

Now, let’s take a look at who is covered by each pension.

Examples

Students

Students over the age of 20 are subject to the National Pension system (Category I insured persons).

After a student comes to Japan and submits a transfer notification to the local municipality, he or she will become obliged to join the National Pension.

On the hand, if a student comes to Japan under the age of 20, he or she will be required to join the National Pension when he or she turns 20.

Having said that, there is a “National Pension Contribution Special Payment System for Students” for certain students. If a student applies for the system and is approved, he or she can be exempt from paying pension payments. Normally, schools should inform foreign students about the system, but we recommend that students check whether they are eligible for it.

Company employees

Company employees who work at an applicable place of business are covered by the Employees’ Pension (Category II insured persons). Normally, companies deduct pension premiums from employees’ salaries to pay for the premiums, so it is unlikely that there will be any problems with non-enrollment or non-payment.

On the other hand, if the company is not an applicable place of business, the company employees of the company will be covered by the National Pension.

Company managers and representative directors

If the company is a mandatory applicable place of business that is required to join the Employees’ Pension, it must first join the Employees’ Pension as a company. In addition, employees must also be enrolled in the Employees’ Pension.

And since company managers and CEOs themselves receive remuneration from their companies, they are considered as a person “who is employed at an applicable place of business” (Article 9 of the Employees’ Pension Insurance Act); and therefore, they must join the Employees’ Pension (Category II insured persons).

The same applies to one-person companies.

Sole proprietors and self-employed workers

Sole proprietors and self-employed workers are subject to the National Pension system (Category I insured persons).

If they employ five or more employees on a regular basis, their office becomes a mandatory applicable place of business that is compulsorily subject to the Employees’ Pension (excluding some industries), even if it is small office.

Even in such cases, the sole proprietors and self-employed workers are not subject to the Employees’ Pension and will be covered by the National Pension.

Spouses of self-employed workers or public servants (whose annual income is below 1,300,000 yen)

Spouses of self-employed workers or public servants who are members of the Employees’ Pension system fall under the “Category III insured persons” of the National Pension System if the spouses’ annual income is below 1,300,000 yen; and therefore, they do not need to pay pension premiums (see Article 94-6 of the National Pension Law).

To be certified as the Category III insured persons, a notification is required. A spouse who wants to be certified must fill out the form, and the employer of the company employee or public servant must submit the form to the pension office having jurisdiction.

Spouses of sole proprietors

Spouses of sole proprietors, even if they are a househusband or housewife, cannot be regarded as a dependent of the sole proprietors and be exempt from paying pension premiums; therefore, they must pay National Pension premiums (Category I insured persons).

On the other hand, if the spouse of a sole proprietor works for a company, etc. and is qualified for the Employees’ Pension, he or she needs to join the Employees’ Pension system at his or her workplace (Category II insured persons).

During unemployment

When you retire, you will no longer be covered by the Employees’ Pension, so you must apply for the National Pension as soon as possible after retiring (Category I insured persons). If you do not apply for the National Pension, your payments of premiums will be considered overdue, so please be careful.

There is a special exemption system for unemployed people, etc., but you must apply for it to use the system.

On the other hand, if you leave your company and become a dependent of a company employee, etc., you must submit a notification to your spouse’s workplace, etc. within 14 days of becoming a dependent (Category II insured persons). In that case, you will not need to pay pension premiums.

The relationship between pension and naturalization

As we have seen, the pension system is complicated, and in some cases, you must submit a notification or apply in order to join the pension system or to be exempted from the payment of premiums. There may be cases where you accidentally forgot to pay, or were not enrolled during the unemployment period. Will naturalization process be affected in those cases?

Let me jump to the conclusion.

Yes, naturalization process will be affected. The situation of pension enrollment and premium payment will be examined as a part of the “conduct requirement” for naturalization.

What is the “conduct requirement”?

One of the requirements for naturalization is “being a person of good conduct” (Article 5, Paragraph 1, Item 3 of the Nationality Act). While it is abstract and difficult to understand, the Ministry of Justice’s website states that “Whether or not one’s conduct is good will be determined from a comprehensive perspective, taking into consideration the presence of criminal records, nature of the crimes, tax payment status, whether or not the person has caused trouble to society, etc., based on social conventions from a viewpoint of an ordinary person.”

(Reference: “Nationality Q&A”)

Pension enrollment and premium payment status will also be examined as one factor of “good conduct.”

How many years of pension payment status will be checked?

Now, you may wonder, “So, how many years of pension premiums must have been paid?”

First of all, there are two types of documents that can be used to prove your pension payment status, which are:

- Pension regular mail (nenkin-teiki-bin); and

- Answer Sheet for Inquiry Regarding Insured Person’s Record (hihokensha-kiroku-shokai-kaitohyo).

Which one you submit is basically optional, and you need to submit records of the most recent one year for Pension regular mail; or all records for Answer Sheet for Inquiry Regarding Insured Person’s Record.

Then, you may think,

“So, I should be okay because I’ve paid for the last twelve months!”

However, it’s not that simple. Even if you have submitted Pension Regular Mails, if there are any points of question, you may be asked to submit the Answer Sheet for Inquiry Regarding Insured Person’s Record. In that case, your payment status will be checked going back more than one year.

As such, you need to pay pension premiums for the most recent one year at least, but even if you have done that, it does not guarantee that you will be okay, so please do not misunderstand.

In case of non-enrollment in pension system or non-payment of pension premiums

As mentioned above, your pension payment status will be checked for at least one year, but if you are not enrolled in pension system at all or have unpaid premiums, do you have to give up on naturalization and build up a payment record for more than one year?

First, if you are not enrolled in the pension system, enrollment is required for naturalization, so you should first enroll and build up a payment record for at least one year.

On the other hand, if you are enrolled in the pension system but have unpaid premiums, you can make retroactive payments for only up to the past two years, so make sure to pay them retroactively.

However, as mentioned above, there is no guarantee that you will have no problems with your pension even if you have paid for one year, and you may be asked to submit records going back.

In addition, one of special features of naturalization is that the actual situation will be investigated from all perspectives, not just based on the documents submitted. Therefore, you cannot simply think, “It’s okay because I haven’t submitted past records.” It is highly likely that the data held by the government will be checked, so it is wiser to consider how to respond based on the assumption that all records will be checked.

Moreover, since pension enrollment and premium payment status are only one element of the conduct requirement, the conclusion may change depending on the correlation with other elements. Even in case that you are asked to submit your entire pension history, even if there was an outstanding payment more than two years ago and you can no longer make a late payment, there should be various reasons for non-payment, and the level of maliciousness varies depending on individual circumstances. Since various factors are intertwined within the framework of the conduct requirement, it is necessary to provide a persuasive explanation for the reasons for past non-payment.

Summary

Naturalization is a serious matter that grants Japanese nationality to foreign nationals, so the screening process is carefully conducted. As a part of such careful screening, each applicant’s past behavior is also checked.

Pension enrollment and payment status of pension premiums are examined as a part of such past behavior.

In particular, in Japan, which is a super-aging society, the pension issues are very serious for Japanese people. Whether a foreign national has been appropriately paying pension premiums in Japan, and whether he or she will continue to pay pension premiums and taxes are a very significant point for the Japanese Legal Affairs Bureau, which approves naturalization.

In addition, whether naturalization will be permitted or not cannot be easily predicted based on the duration of pension payment, etc., and the conclusion may differ depending on the situation of each applicant, so if you have any concerns about pensions, we recommend that you consult with an experienced expert.

Our firm has extensive experience in the area of naturalization. If you are considering naturalization and are worried about your pension enrollment and/or payment status of pension premiums, please feel free to contact us.

We are Yanagi group, which have offices in Osaka (Abeno and Tennoji), and our affiliated offices in Tokyo (Shibuya and Ebisu) are also available for an on-site consultation. We have handled many applications for permanent residence permits, naturalization permits, work visas, college student visas, management visas, etc., as well as visa renewal procedures related to the status of residence with the Immigration Bureau (Immigration Bureau) as a one-stop service. Our experienced administrative scriveners are also available to help you with any problems you may have.

We also have staff members who can speak each of the native languages and can assist you in obtaining a visa.

※If you wish to be consulted in Nepali or Bengali, please inform us in advance via our website or social media, and the translator will contact you ahead of time.

Please feel free to contact us if you have any questions about your status of residence or visa, even if they are trivial.

Editor of this article

- Ryota Yanagimoto

- Administrative Scrivener/Judicial Scrivener

At the age of 24, he passed the national examinations for judicial scrivener, administrative scrivener, and wage service manager at the same time.

While working as a full-time lecturer at a major prep school, he independently opened a legal office related to judicial scriveners and administrative scriveners,

and he has experience as a judicial scrivener and an administrative scrivener for more than 15 years so far.

He has been actively contributing to various industries such as publicly listed companies, real estate companies, financial institutions, elderly care services, and professional organizations by conducting seminars, lectures, and talks.

And now he has a record of over 60 presentations so far.

Furthermore, as the president of a Japanese language school announced by the Ministry of Justice and Acts, and an advisor to a real estate company (capable of handling foreign clients),

he has been involved in various aspects of industries related to foreigners.

It is recommended to consult with experts when it comes to visas, naturalization, and residency matters.

Our office has specialized experts in visa and naturalization applications who are available to assist with free consultations (limited to the first session) and inquiries related to various visa applications and naturalization applications.

Additionally, we have foreign staff proficient in English, Chinese, and Korean languages with specialized knowledge, and they are present to provide support. They can accommodate consultations and inquiries in each language. Feel free to use our free consultation and inquiry services from here.

0120-138-552

0120-138-552 Free

Consultation

Free

Consultation Contact Us

Contact Us