Staying in Japan

How to Purchase the Real Estate in Japan as Foreigners

- 2024.05.14

In this article we will introduce you the necessary procedure of buying real estate in Japan as foreigners, as we believe many of you are having the similar question on this issue.

Are foreigners eligible to purchase real estate in Japan?

The same as Japanese nationals, the foreigners are eligible to buy real estate in Japan. For those who live outside the country and plan to buy real estate of the country may receive various regulations and therefore may not be able to buy the real estate of the country, however for Japan, this won’t be a problem. Of course the acquisition tax and property tax need to be properly paid as Japanese nationals.

The procedure of purchasing

Again, the procedure of purchasing the real estate in Japan as foreigners is almost the same as for Japanese nationals. Generally speaking, the procedure is as following:

- Search for property

- Submit the purchase certificate (once the purchase is decided)

- Confirm the investment fund

- Receive explanation on essential points

- Register the ownership

- Receipt of the property

- Decide the payment method

- Report to the minister of Finance

Let’s have further insight of all points one by one.

- Search for property

Look for the property according to buyer’s wishes, in this situation, you can do either walk in to the agent’s office directly or try to search the properties online.

As the online searching takes time and effort, especially many properties for purchase are not available to be seen online, so we would suggest that the better way is to talk to the real estate agent directly.

- Submit the purchase certificate (once the purchase is decided)

The purchase certificate is submitted to the real estate agent to screen the property information and once the conditions are matched, the certificate will be forwarded to the seller or to the real estate company. This kind of document may have different names, but they all serve the same purpose, which is to tell the seller or to the real estate agent that “I am interested in this property and I’d like to buy it with this amount of money.”

- Confirm the investment fund

The fund for purchasing needs to be prepared once the buying decision is made.

As the Japanese usually pay mortgage while purchasing the real estate, application of the mortgage can be done through the bank directly or through the real estate agents.

As for the mortgage application by foreigners, it is usually provided to those who have already acquired permanent residence. As for those who have not, in most cases you need to pay by cash.

Once the payment method is decided, and the examination of the mortgage application is passed, there comes the contract part, at this point, the deposit as part of the whole payment will be required. Besides, the agent fee and the contract stamp fee will also be required by the real estate agent.

Even if the payment is done at one time without any down payment, in most cases, you will be required to pay the deposit by cash. Though the percentage of the deposit varies, the real estate agents usually have their own standard, or have it done according to the seller’s requirement, so make sure confirm beforehand.

Basically, the part of agent fee is required at the point of signing the contract. The rest can be paid at the receipt of the property.

The contract stamp fee is something different from the purchase payment, please pay attention to it.

What’s more, the property needs to be registered at the point of purchase, to do so the expense of hiring a judicial scrivener needs to be considered. Besides, the insurance for mortgage, for fire damage and so on are required as well, usually this kind of expense takes approximately 10% of the total payment.

- The essential points notification

The essential points notification is delivered from the real estate company to the buyer.

The content of the essential points notification includes the payment method, the rights of real estate, and legal restrictions. Besides, it also indicates the solution at the cancellation of the contract. Please confirm all points as thoroughly as you can.

As the contract is the official document that transfers the right from the real estate company to the buyer, please make sure the below documents are properly prepared before signing the contract.

The documents required

・Registered seal

※ Signature and stamp

※ Proof of home address

・In case of no home address is available, please submit signature certification and affidavit

・Passport

The signature is required instead of stamp are common in many countries, however, when signing a contract in Japan, the stamp is necessary, there please make sure the stamp is prepared beforehand.

If the applicant doesn’t live in Japan, he is not able to register the signature and stamp and not able to receive the stamp certification, in which situation, the affidavit as well as the signature certification provided by the Japanese Embassy can be submitted instead. However, depends on the country, there are times the local Japanese Embassy and Consulate General are able to provide such documents, please confirm beforehand.

※ If there is a business office in Japan, prepare the certificate of qualification such as representative details certificate, resume details certificate, etc. that is issued by the Ministry of Justice; if there is not the business office, official certification from your home country and the translated version are required (translator’s signature and stamp are required)

if you are not able to provide neither of the above, please get the affidavit prepared.

※ About the affidavit

An affidavit is done by those who write down the facts he or she knows and swears that the contents are true in the presence of the embassy officer or a notary in his country. This is a certificate with seal attached after confirming that the person who makes the oath is the same person who is in favor of the consequences of the oath, and also the oath has to be done by in person.

In addition to this, in the case which an agent does the procedure on behalf of the foreigner who does not understand Japanese, or when the agent performs the purchase procedure without having the person come to Japan, documents including the proxy and the identification of the agent, as well as the seal certificate are necessary.

- Registration of ownership

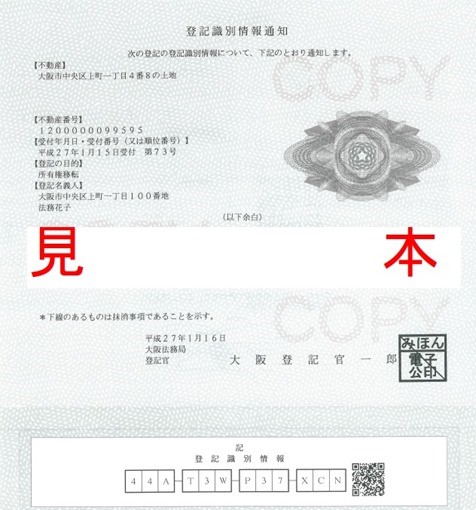

Once the contract is signed and the payment is done, the ownership of the real estate needs to be registered at the Legal Affairs Bureau.

Once the registration is complete, the new owner will receive a notification letter of registered information.

- The receipt of the property

Once the contract is signed, the payment is complete. It is about time to move in to the property.

At the receipt of the real estate, the ownership needs to be renewed, please make sure register at the Legal Affairs Bureau, and procedure is usually done with assistance of the judicial scrivener.

In addition, upon acquisition of the real estate as foreigner. The status needs to be reported to the Ministry of Finance via a Japanese bank within 20 days of the acquisition, according to the Foreign Exchange Law.

However, for the following cases, the report is not mandatory.

・The property is bought from the foreigner who has already been living in Japan

・For purposes of providing place to live for relatives or for employees

・The property is bought from the foreigner who does not live in Japan and for non-residential purpose

・The property is bought as office

・The property is bought for non-business purpose

- The payment method at purchasing

As mentioned above, the house mortgage is only provided to foreigners who has gained the permanent residence, in which case, only the cash payment is accepted. If the cash payment is difficult, the house mortgage from your home country can be considered.

(1) Payment by international remittance

Almost no foreigners have the Japanese bank account, in many cases, the international remittance is the only choice.

In most cases, the recipient of the international remittance is the real estate agent. As a great amount of money will be transferred to the account of the agent, it is important to choose the agent with reliability.

As great amount of money is involved during the international remittance, please make sure you keep all related payment documents. If the transfer is made, keep the receipt, at the same time, try to get the currency exchange slip from the bank.

(2) Payment by check

When purchasing real estate from abroad, besides of cash and remittance, the payment can also be done by check.

However, as the amount is much, it is most likely that only the deposit check is accepted.

On the other hand, most sellers are not fond of the deposit check as it takes time to exchange into cash. Because it may cause that the contract does not go smoothly, the international remittance is recommended.

- Report to the Finance Minister

The status needs to be reported to the Minister of Finance within 20 days after the real estate is acquired. This is because when a foreigner purchases real estate in Japan, according to foreign exchange law and foreign trade law, it is obligatory to report to the Minister of Finance after acquisition of the real estate.

The tax arrangement at purchasing of real estate as foreigner

The tax needs to be collected at the purchasing of real estate in Japan, even the buyer is a foreigner, the rules are same. Different taxes are summarized as below.

(1) Real estate acquisition tax

Based on the payment of the real estate, the tax is collected accordingly.

The general calculation goes like “Standard tax amount of acquired real estate x tax rate”.

(2) Certificate registration tax

This tax is collected at registration of the real estate, usually 20/1,000 of the Standard tax amount of acquired real estate is required, as for the tax of the land registration, tax rate of 15/1,000 was applied since 31st March 2020.

- Tax to paid annually

(1) Property tax

This tax is collected on 1st of January annually from the real estate owners.

(2) City tax

Like the property tax, it is collected on 1st of January annually from the real estate owners, it is collected for developing the city.

※ the standard tax amount of real estate is subject to the property tax book stored at the city hall.

(3) Income tax

If the real estate is bought for investment purpose, based on the income generated, according tax is collected. The amount of the tax is subject to the annual declaration, certain amount is deducted from final amount as necessary expense.

- The tax payment method

The payment letter for all above taxes will be sent, once the letter is received, items that need to be paid will be listed in the letter, and the payment can be done at either bank, post office or at convenience store.

As the payment is not accepted for foreigners who do not live in Japan, if that’s the case, please sign the task to a tax manager who can pay the tax on your behalf. Once the tax manager is decided, the tax payment letter will be delivered to the manager.

It does not matter who to sign as the tax manager, thus, many would go for the lawyer and the accountant. If you have no friend to trust in Japan, it would be better to ask help from the professionals

Summery

We have explained the procedure of purchasing the real estate as foreigners in Japan. Expect of the payment method, the other procedure is done as same as Japanese nationals.

If you are not able to communicate in Japanese, there might be problems happening during the process, so please pay attention.

It is likely to choose a property with bad conditions at unreasonable price if you try to make the purchase from outside of Japan, to avoid such problem, it is very important to choose a real estate agent with credibility.

In addition, you could ask a Japanese or someone who knows the rules in Japan very well as your personal agent to prevent above problems.

During the purchasing process, many real estate related terminologies are involved, if you are not confident to understand those expressions in Japanese very well, please ask professionals for assistance.

There are many real estate agents who are mainly dealing with foreigner client in recent years, also many companies have hired English speaking staff, especially in places where foreigners reside, it’s not difficult to find one, so please ask help from them.

Our company provide service such as our life–support interpreters who are familiar with legal terminologies can go with you to deal with related matters upon request.

The YANAGI Administrative Scrivener Group process about 1500 cases of real estate business, and we are happy to assist you with real estate related inquiries, please feel free to contact.

We are Yanagi group, which have offices in Osaka (Abeno and Tennoji), and our affiliated offices in Tokyo (Shibuya and Ebisu) are also available for an on-site consultation. We have handled many applications for permanent residence permits, naturalization permits, work visas, college student visas, management visas, etc., as well as visa renewal procedures related to the status of residence with the Immigration Bureau (Immigration Bureau) as a one-stop service. Our experienced administrative scriveners are also available to help you with any problems you may have.

We also have staff members who can speak each of the native languages and can assist you in obtaining a visa.

※If you wish to be consulted in Nepali or Bengali, please inform us in advance via our website or social media, and the translator will contact you ahead of time.

Please feel free to contact us if you have any questions about your status of residence or visa, even if they are trivial.

Toll-free number: 0120-138-552

For English speakers: 080-9346-2991

For Chinese speakers: 090-8456-6196

For Korean speakers: 090-8448-2133

For Vietnamese speakers: 080-5510-2593

Editor of this article

- Ryota Yanagimoto

- Administrative Scrivener/Judicial Scrivener

At the age of 24, he passed the national examinations for judicial scrivener, administrative scrivener, and wage service manager at the same time.

While working as a full-time lecturer at a major prep school, he independently opened a legal office related to judicial scriveners and administrative scriveners,

and he has experience as a judicial scrivener and an administrative scrivener for more than 15 years so far.

He has been actively contributing to various industries such as publicly listed companies, real estate companies, financial institutions, elderly care services, and professional organizations by conducting seminars, lectures, and talks.

And now he has a record of over 60 presentations so far.

Furthermore, as the president of a Japanese language school announced by the Ministry of Justice and Acts, and an advisor to a real estate company (capable of handling foreign clients),

he has been involved in various aspects of industries related to foreigners.

It is recommended to consult with experts when it comes to visas, naturalization, and residency matters.

Our office has specialized experts in visa and naturalization applications who are available to assist with free consultations (limited to the first session) and inquiries related to various visa applications and naturalization applications.

Additionally, we have foreign staff proficient in English, Chinese, and Korean languages with specialized knowledge, and they are present to provide support. They can accommodate consultations and inquiries in each language. Feel free to use our free consultation and inquiry services from here.

0120-138-552

0120-138-552 Free

Consultation

Free

Consultation Contact Us

Contact Us